What is the 50/30/20 Rule in Budgeting?

Managing your money doesn’t have to be complicated. If you want to take control of your finances without the stress of complicated spreadsheets, the 50/30/20 rule is a great place to start. It’s a simple, effective method to balance your needs, wants, and savings and bring discipline to your financial life.

What is the 50/30/20 rule in budgeting?

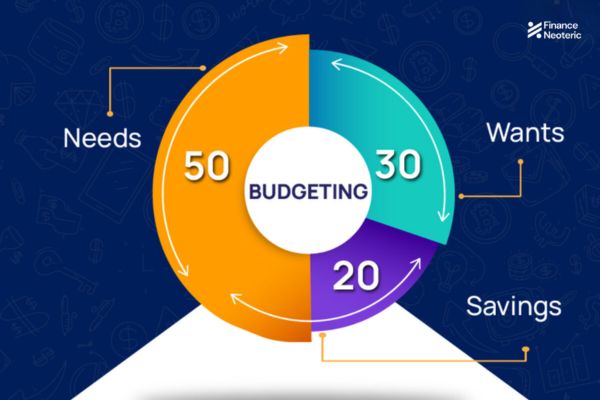

The 50/30/20 rule is a budgeting method that divides your income into three parts: 50% for needs (like rent and groceries), 30% for wants (entertainment or shopping), and 20% for savings and debt repayment.

This helps you manage your money smartly, stay within limits, and plan for the future with clarity.

Also Read:- Learn the basics of personal finance and why it matters

How does the 50/30/20 rule work?

Let’s say you earn ₹50,000 per month. Here’s how you could apply the 50/30/20 rule:

- ₹25,000 (50%) for needs: Rent, electricity, groceries, transport, insurance

- ₹15,000 (30%) for wants: Dining out, OTT subscriptions, shopping, leisure

- ₹10,000 (20%) for savings/debt: SIPs, emergency fund, loan EMI, investments

- This structure creates balance. You meet your essentials, enjoy your lifestyle, and still make progress towards financial goals.

Why is the 50/30/20 rule useful?

- Simplicity: No complex formulas or apps required

- Flexibility: Works for salaried, freelancers, and business owners

- Clarity: Keeps your spending in check

- Discipline: Builds the habit of saving monthly

It’s especially useful for young professionals, students entering the workforce, or anyone starting their personal finance journey.

Also Read:- Explore why managing money matters from college to career

Is the 50/30/20 rule right for everyone?

While the 50/30/20 rule is a great starting point, it may need adjustment depending on your income and responsibilities.

- If your income is lower, you may spend more than 50% on needs.

- If you have no debt and strong savings, you may reduce the 20% portion and invest more.

- The key is adapting the rule to your reality while keeping the basic structure.

Budgeting is not about restrictions. It’s about understanding where your money goes and making informed choices. The 50/30/20 rule offers a clean, structured way to manage your finances without feeling overwhelmed.

If you’re just starting your personal finance journey, this method can help you build healthy money habits that last a lifetime.

Stay connected with FinanceNeoteric on WhatsApp Channel for expert coverage and in-depth financial stories.

Disclaimer: This post is for general informational purposes only. It does not constitute financial advice. Please consult a qualified professional before making financial decisions.