Nvidia Beats Q1 Revenue Estimates, Warns of $8 Billion Hit from China Export Curbs

Nvidia, the leading AI chipmaker, reported stronger-than-expected first-quarter earnings, but flagged a significant $8 billion impact from US export restrictions to China.

The company posted revenue of $44.1 billion in Q1 FY25, exceeding analyst expectations of $43.3 billion, according to Bloomberg data. This marks a sharp increase from $26 billion in the same quarter last year, reflecting the continued surge in demand for AI hardware globally.

Adjusted earnings per share stood at $0.96, topping Wall Street estimates of $0.93 and up from $0.61 a year ago. However, revenue from its crucial data center segment—Nvidia’s fastest-growing business—came in slightly below forecasts at $39.1 billion, compared to an estimated $39.2 billion. The segment generated $22.5 billion in the corresponding quarter last year.

Also Read:- GameStop Invests $513 Million in Bitcoin Amid Strategic Crypto Pivot

Despite the upbeat earnings, Nvidia flagged a major challenge ahead: the company expects a revenue hit of up to $8 billion in the next quarter due to tightened US export controls on AI chips to China.

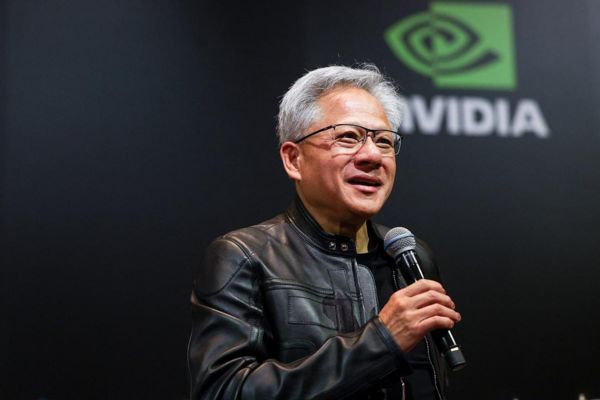

Nvidia CEO Jensen Huang, in a recent interview, revealed that the company had already lost $15 billion in sales because of these export curbs. “The $50 billion China market is effectively closed to US industry,” he said. “The H20 export ban ended our Hopper data center business in China. We cannot reduce Hopper further to comply.”

While the company is exploring limited options to remain competitive in the Chinese market, Huang admitted that “Hopper is no longer an option,” noting that China’s AI development will continue with or without US technology.

Following the earnings announcement, Nvidia’s shares jumped over 4% in after-hours trading.

Also Read:- Trump Media to Invest $2.5 Billion in Bitcoin Through Institutional Fundraise

As the poster company of the ongoing AI revolution, Nvidia remains a bellwether for tech investors. However, the evolving geopolitical landscape could continue to weigh on its long-term strategy, particularly in key markets like China.

Stay connected with FinanceNeoteric on WhatsApp Channel for expert coverage and in-depth financial stories.

Disclaimer: This post is for general informational purposes only. It does not constitute financial advice. Please consult a qualified professional before making financial decisions.